Dual Momentum is a robust portfolio allocation tool. Relative 12 month returns are used to rank assets. Shelter is sought in a safe asset when 12 month absolute returns fall below a threshold.

Gary Antonacci describes Global Equities Momentum using US and International stock indexes with Bonds as the safe asset. Annual returns are 17.4% since 1974. However, my previous post showed the potential return hit when the 30 year bond bull ends and prices start to fall.

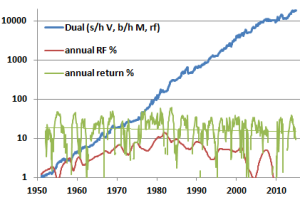

One promising solution is to use factor portfolios based on Value and Momentum and shelter in a ‘Risk-Free’ asset during downturns. Results from this strategy are not biased by recent bull markets. Value and Momentum are somewhat uncorrelated, enhancing returns, and supported by a vast literature showing persistent outperformance over many decades.

As the Value effect is known to apply only to small firms, I used the small-high Value dataset from the 2×3 portfolio at Ken French’s library. The momentum anomaly is not limited to specific market segments so the big-high Momentum portfolio was used.

Average annual compound return is 16.6% and consistent throughout the 60+ year test period (see green rolling return and red annual Risk-Free%).

Return is greater than each data series individually. Using 6 or 4 month dual momentum gives similar results.

VBR and PDP are ETFs that can be used to mimic these portfolios. The next post will look at tracking of these ETFs relative to the 2×3 portfolios and their current momentum status.

Pingback: Dual momentum: real portfolios and current status | RRSP Strategy

rrspstrategy,

I’ve been testing a similar strategy and it would be nice to see additional stats for comparison, ie: volatility, sharpe, max drawdown, k-ratio.

Cheers, Steve

OK, sure. I’m planning to cover different lookbacks next week and will add the stats.

Pingback: Factor Dual Momentum status and plea for data | RRSP Strategy

Pingback: 3 Factor Dual Momentum: Value, Momentum and Low Volatility (or BAB) | RRSP Strategy

Pingback: Does sector momentum outperform stock momentum? | RRSP Strategy

Antonacci doesn’t use long duration bonds in his formulation of dual momentum. He uses aggregate bonds with a duration of around 5 years. Have you looked at using short to intermediate term bonds like he does?

Good point, thanks. I’ve looked at 10 year bonds but will search for a 60+ year dataset of ~5 year bonds for future tests. Let me know if you have one.

Do you do an analysis each month on selecting the asset to invest in?

Very shortly this web page will be famous among all blog users, due to

it’s pleasant content