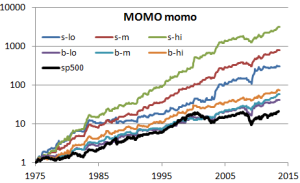

An earlier post discussed Fama-French momentum, in particular small-cap with annual returns above 20%.

By adding the simple rule of holding cash when the previous monthly portfolio return is negative, remarkable improvements are realized:

Annual return is little changed but volatility is reduced and Sharpe is increased from 1.1 to 1.5 for small-cap momentum (upper green trace).

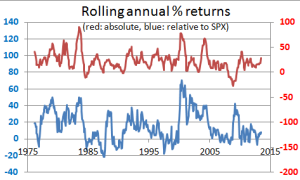

The rolling annual performance shows that down years are almost eliminated (red) but it is still possible to trail the S&P 500 in some periods (blue):

If you go cash when the last month is negative, when you come back to the market ?

Following a positive month. The strategy is in the market 2/3 of the time.

Is it total returns (with dividends) on the top chart or just price returns?

Total return but the yield on small-cap momentum stocks is low. More details on the portfolios here: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/Data_Library/det_6_port_form_sz_pr_12_2.html

ok, just to make sure you know that comparing total return results with price index can be misleading 🙂

Good point, thanks. I should replace the s&p trace with total return.

Edit: struggling to find a TR series to 1975, can anyone provide a link?

Pingback: Small-cap momentum: S&P 600 analysis | RRSP Strategy

I do not believe there is free numbers for the total return series. But one “solution” you could to is so “simulate” the index return plus the average yield since 1975. I.e. if you only care to compare Total momentum returns with total S&P returns.

If have a question also with regards to:

“By adding the simple rule of holding cash when the previous monthly return is negative, remarkable improvements are realized:”

Do you mean that if the equal weighted return for the portfolio is positive over the look-back period then you are in the market and otherwise in cash? Or what exactly do you mean by; ” if the monthly return is negative then…”

Peter, thank you for your comments, I should look at adding the yield to make a TR index. The other options I looked at are ^GSPC (available to mid-80s) or Fama-French “market” series.

Your interpretation is correct, except I am using the value weighted portfolio. So if the portfolio return is positive, I buy it the next month and re-evaluate each month.

I will post on the difference between equal and value weighting schemes but it is small for momentum.

Pingback: Импульс Фама-Френча: добавляет фильтр и улучшаем коэффициент Шарпа — Long/Short