Robert Novy-Marx finds that momentum is driven by price change in the first half of the preceding year, irrespective of recent performance. Most studies use the whole year price change, excluding the most recent month.

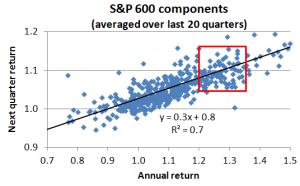

To investigate this result, I revisited my previous analysis of S&P small cap stocks since 2008 which showed that annual gains of about 25% led to an average 10% gain next quarter:*

* These data are out of sample relative to the Novy-Marx paper.

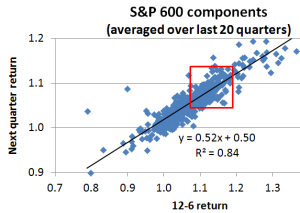

The correlation between next quarter return and return in the first half of the preceding year is much closer (r^2 increases from 0.66 to 0.84):

Investigation is needed on whether any characteristics of recent performance can segment returns even further. Value and earnings surprise would be logical starting points.

Interesting.

If you start with the current set of companies in NASDAQ 100, and every six months buy the top five on the basis of prior six months’ performance, here is what you get:

CAGR (1999-2013) 54.1%

Number of Years of losses: 2 (2008 -19.8%, 2002 -0.22%)

This set of parameters seems to be optimal for the six month momentum.

Thanks for that result, which is impressive, although survivor bias will make quite a difference over that timeframe. Did you use 6 month momentum, lagged 6 months (12-7) per this post? If not, that should improve returns.

Pingback: Intermediate Term Stock Rotation Strategy Using S&P500 Stocks » Alvarez Quant Trading