XIV is an ETN which targets the inverse daily return of VIX by shorting VIX futures.

As the monthly options cycle progresses, at the end of each business day the fund gradually transitions from the first month future to second month future. Normally (80% of the time), the longer contract is higher priced therefore selling (shorting) high and buying low. This is known as positive “roll yield” or “term” structural advantage.

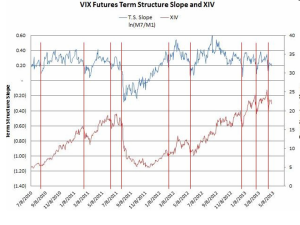

This excellent chart from Trading Volatility shows the relationship:

Volatility tends to decrease during stock market rallies, reducing VIX and increasing XIV.

An alternative viewpoint is that the high returns result from the volatility risk premium (highly recommended) i.e. the risk of an explosion in volatility while holding XIV. Theoretically, XIV can go to zero overnight if VIX triples (approximately). The trade-off is ~100% per annum returns from 2004-2007 and 2009-2013.

One idea is to hold most of the portfolio in low beta funds (total return ~20% outside recessions) with, say, 10% allocated to a XIV “roll yield” and/or “breadth based” strategy. This could boost total annual returns by 10% (to 30%) with a small chance of XIV going to zero (probably during a recession but could be any time).

XIV allocation should be tax sheltered due to higher transaction frequency and sized so that the zero case is not catastrophic.

Pingback: Daily Wrap for 5/12/2013 | The Whole Street

Pingback: Momentum Investing: Instrument selection is critical | RRSP Strategy