This series looks at US stock market seasonality on various timeframes. The Fama-French (FF) daily book-to-market (B/M) portfolios are used.

Marketsci has posted extensively on this topic, showing that “strong” and “weak” days tend to persist on a walk-forward basis.

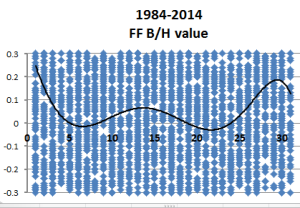

This analysis is slightly different in that calendar days are used rather than trading days. Daily return is plotted against day of the month from 1984-2014.

The trendline shows that calendar days 1,2 and 25-31 have higher average returns than other days, irrespective of where the weekend falls.

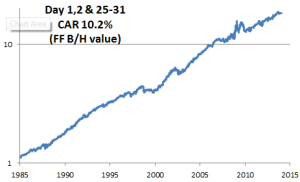

Holding the FF large value portfolio on days 1,2 and 25-31 results in the following equity curve (frictionless). Annual return is 10.2% with an exposure around 25% and 12 trades per year.

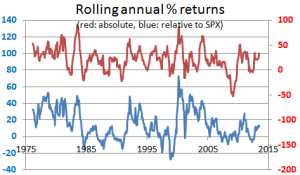

It’s interesting that even during the last 2 recessions, these days perform well. (See 2000-2002 and 2008).

This may work better with the addition of short term entry and exit triggers but I have yet to investigate. The intent of the equity curve is only to illustrate the principle.

Next up: day-of-year seasonality.